The smarter way to accelerate your customer acquisition

See for yourselfThe smarter way to accelerate your customer acquisition

See for yourselfThe smarter way to accelerate your customer acquisition

See for yourselfSolutions for...

The smarter way to accelerate your customer acquisition

See for yourselfThe smarter way to accelerate your customer acquisition

See for yourselfThe smarter way to accelerate your customer acquisition

See for yourselfSolutions for...

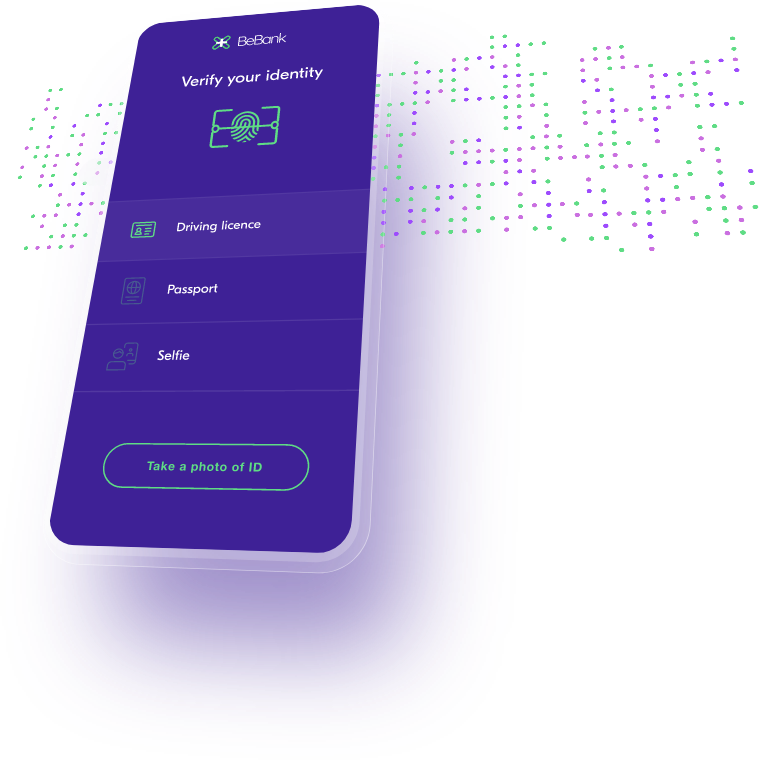

The Express Compliance & Authentication Module automates regulatory compliance delivering complete accurate results in seconds. Customer data input is minimized as real-time 3rd party data sources are used to provide identity, AML, and fraud profiles.

Multiple data sources and partners

Multiple data sources and partners provide KYC/KYB, AML, Financial Crime, sanctions data, credit bureau, Open Banking, and more.

Customisable decisioning engine

Customisable decisioning engine conforms to your compliance rules and standards.

Decisioning optimization based on advanced BI analytics

Data sources internationally adaptable

Leverage existing Ezbob data agreements

...to speed implementation time

Integration with your blacklist/whitelist

API connectivity to any existing user interface or back-office systems

Metro Bank saw an immediate improvement across the board…

fully automated approvals

of loans accepted and signed

completed application in under 5 minutes

Read the case study

Let us show you how we can transform your lending with breakthrough technology that will deliver results for your business.

Get in touch“Ezbob aggregates data into one central place to help us assess it quickly.”Esme Bank - View case study

Automated. Accurate. Engaging.

Ezbob can quickly customise its solutions to your needs and operating environment. As a cloud-based platform there is no hardware to buy or lengthy development process needed.

Are you ready to take your lending to the next level with ezbob's embedded finance platform? Book a demo today to see how we can help you enable funding quickly and easily, with fully automated digital onboarding and advanced decision-making algorithms.